Economic Indicators Q3 2025

COEDC News November 3, 2025

As the summer of 2025 unfolded, the Central Okanagan’s economy continued to demonstrate both resilience and dynamism. The third quarter depicted steady growth and subtle shifts that are shaping the region’s economic narrative.

Labour Market: Low Unemployment, Steady Employment and Job Postings

The Central Okanagan labour market in Q3 2025 showed signs of accelerated economic engagement and resilience. While the unemployment rate remained unchanged comparing 2024 Q3 to 2025 Q3 at 4.9%, this stability marks a recovery from the previous quarter’s higher rate of 5.8%, suggesting that those in the labour force were successful in gaining employment (Statistics Canada). This rate is notably lower than Canada’s national unemployment rate of 7.03% and British Columbia’s rate of 6.17% for the same period. Employment figures reinforce this trend, with a notable increase to 128,167 jobs —up from both Q3 2024 (113,433) and Q2 2025 (112,467)—indicating strong job growth across the region (Statistics Canada). The labour force participation rate climbed to 64.0%, up from 59.7% in Q3 2024, and the size of the regional labour force also increased by 12.97% to an average of 134,733 individuals in Q3 2025, reflecting more individuals entering the workforce. Please note that Statistics Canada advises against analyzing regional labour force data month-to-month due to small sample sizes causing volatility. Therefore, the COEDC reviews unemployment trends quarterly or annually.

The Central Okanagan saw a notable increase in job postings in Q3 2025, with a total of 2,922 postings—a 14.95 % increase compared to 2,542 postings in Q3 2024 (Vicinity Jobs). This growth reflects heightened labour demand across key sectors. For instance, Retail Trade led with 568 postings, likely driven by seasonal hiring and sustained consumer activity in the region (Vicinity Jobs). Accommodation and Food Services followed closely with 528 postings, suggesting a continued demand in tourism and hospitality, (Vicinity Jobs). Healthcare and Social Assistance recorded 465 postings, highlighting the demand for health professionals amid demographic shifts and service expansion (Vicinity Jobs).

Housing Starts vs Building Permits

Between Q3 2024 and Q3 2025, the Central Okanagan experienced a notable divergence in housing market indicators. Cumulative housing starts from January to September declined by 41.85%, dropping from 3,667 units in 2024 to 2,132 units in 2025, suggesting a slowdown in the volume of new residential construction (Canadian Mortgage and Housing Corporation). In contrast, the total value of building permits in the region surged by 34.96%, rising from $852,631,762 to $1,151,010,457 in the same period (COEDC Data Portal). This increase in building permit values may indicate a shift toward larger or more complex developments such as multi-family developments, and commercial and institutional projects that may require larger investments per unit.

Median New Home Price

Median new home price in the Central Okanagan region experienced an increase from $1,307,500 in Q3 2024 to $1,690,000 in Q3 2025 (Canadian Mortgage and Housing Corporation). In comparison, Vancouver recorded a median new home price at $2,287,500, followed by Victoria at $1,527,500, Toronto at $1,450,000 and Calgary at $775,000.

Summer Takes Flight: Kelowna Airport Traffic Boosts Tourism

Passenger traffic at Kelowna International Airport continued its upward trajectory averaging 190,806 passengers from January to August 2025, an increase from 175,762 during the same period in 2024 (COEDC Data Portal). This growth signals a strong recovery in air travel demand, likely driven by increased tourism, business travel, and expanded flight connectivity. The year-over-year increase of nearly 8.6% suggests that the region’s economic momentum and population growth are translating into higher mobility. This reinforces the airport’s role as a critical hub for business and leisure travel—further supported by the Central Okanagan’s growing appeal as a top summer destination, with strong booking trends and outdoor offerings that align with Canadian travellers’ interest in lakes, mountains, and national parks (Tourism Kelowna).

Q3 2025 reinforced the Central Okanagan’s position as a resilient and evolving economy. Labour market strength was evident through a steady unemployment rate, which remained lower than both provincial and national averages, rising employment, and increased job postings across key sectors. Housing trends revealed a shift toward higher-value developments, with permit values surging despite fewer starts, while median new home prices saw an increase compared to Q3 2024,, reflecting persistent demand and supply constraints. The Central Okanagan welcomed a summer surge in tourism, fueled by rising airport passenger traffic and a lineup of major events including the CCMA Awards. With growing international attention and heightened domestic travel interest, the region was primed for a season of strong economic impact and unforgettable visitor experiences.

To explore more detailed data, economic indicators and insights, visit our data portal.

You Might Also Like...

Economic Indicators Q4 2025

Economic Indicators February 9, 2026

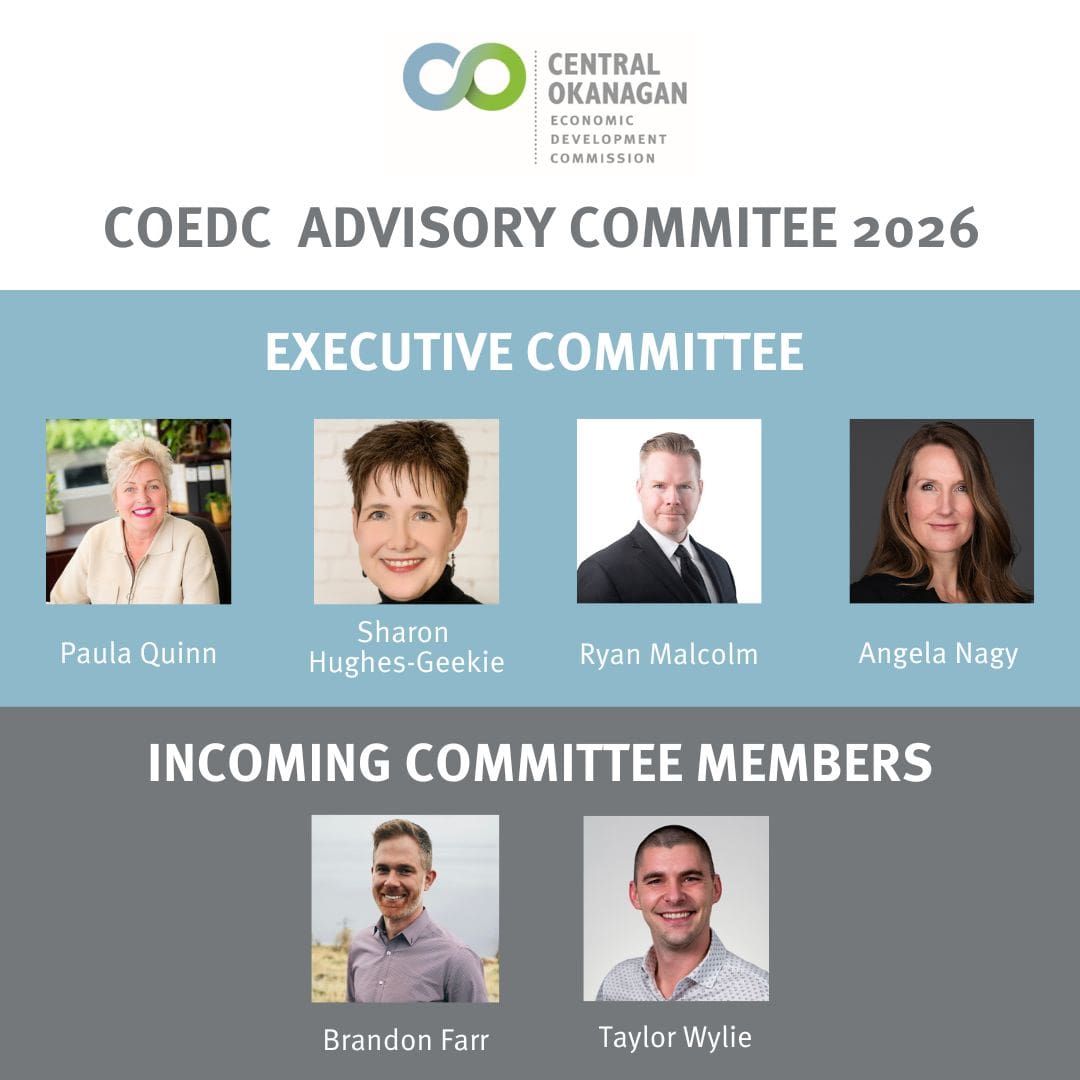

COEDC announces 2026 Advisory Committee members

The committee convenes monthly to exchange information and works to foster sustainable economic growth in…

Advisory Committee January 30, 2026

Okanagan Manufacturing Network launches to unite and strengthen local manufacturers

New association connects, supports and celebrates the makers powering the Okanagan economy

COEDC News January 16, 2026